In February 2023, the MLS® System of the London and St. Thomas Association of REALTORS® (LSTAR) recorded only 436 residential transactions, thus marking the lowest number of February home sales seen by LSTAR since 1995.

Despite the sluggish sales, 761 new listings entered the market during the same time frame, bringing the number of active listings to 1,320 by month-end. The overall sales-to-new listings ratio for the entire jurisdiction of LSTAR was 57.3%.

Compared to February 2022, both the overall average home price and the composite MLS® Home Price Index (HPI) Benchmark Price were significantly lower, down 24.2% and 25.1%, respectively. Despite this, both metrics saw a modest month-over-month growth. LSTAR's overall average home price was $621,912 last month, while the composite MLS® HPI Benchmark Price came in at $583,500.

“With the Bank of Canada signalling that interest rates may have peaked and the consumer confidence index sitting at its highest level since September, I am feeling optimistic about the local housing market. The frantic bidding wars of the past seem to be now in our rearview mirror. And home buyers are getting more and more comfortable with taking on variable-rate mortgages, feeling encouraged by this much calmer environment. In these conditions, the spring market could surprise us,” said 2023 LSTAR President Adam Miller.

To further understand the market, the following table illustrates February's average home prices in LSTAR's main regions compared to the benchmark prices for those same areas.

| Area | February 2023 MLS® HPI Benchmark Price | February 2023 Average Price |

|---|---|---|

| Central Elgin | $581,600 | $772,488 |

| London East | $473,500 | $545,823 |

| London North | $701,900 | $716,079 |

| London South | $579,700 | $591,098 |

| Middlesex Centre | $833,600 | $901,034 |

| St. Thomas | $499,100 | $552,500 |

| Strathroy-Caradoc | $713,500 | $672,013 |

| LSTAR | $583,500 | $621,912 |

In February, the single-family home continued to be the most desirable housing type in our area, with a total of 325 transactions recorded. Following closely behind was the condo townhouse, which saw 56 units exchanging hands. In contrast, the apartment lagged with only 34 units sold during the same period.

“Out of all house types, single-family homes were the ones that drove the month-over-month increases we noticed in the average and benchmark prices. Last month, the average price of a single-family home was $673,226 in our area, 25.2% lower than in February 2022, but also 5.6% higher than in January 2023. In addition, its MLS® HPI benchmark price was 4% higher than in the previous month,” Miller observed.

Providing a comprehensive overview of the benchmark prices for all housing types in LSTAR jurisdiction, the following table presents the figures for February 2023. This data allows for a direct comparison with the benchmark prices from the preceding years of 2022 and 2020.

|

|

|||

|---|---|---|---|

| BENCHMARK TYPE | FEBRUARY 2023 | CHANGE OVER FEBRUARY 2022 | CHANGE OVER FEBRUARY 2020 |

| LSTAR Composite | $583,500 | ↓25.1% | ↑44.0% |

| LSTAR Single-Family | $628,300 | ↓25.0% | ↑46.4% |

| LSTAR One Storey | $558,400 | ↓25.2% | ↑43.0% |

| LSTAR Two Storey | $676,300 | ↓24.8% | ↑48.4% |

| LSTAR Townhouse | $489,400 | ↓25.7% | ↑43.3% |

| LSTAR Apartment | $353,800 | ↓26.1% | ↑18.2% |

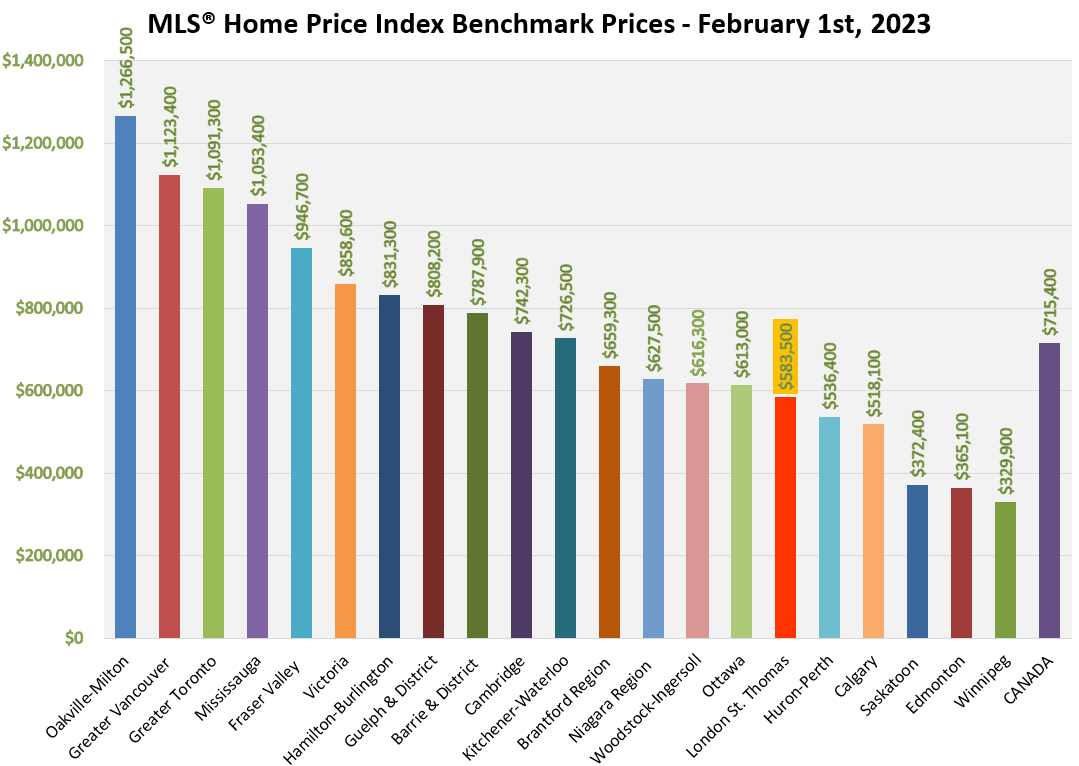

“When compared to other values recorded provincially and nationally, homes in our area continue to be reasonably priced,” Miller said. The following table shows HPI benchmark prices for February, courtesy of CREA.

In 2019, Altus Group, a leading research and advisory firm, released a report1 shedding light on the ancillary expenditures associated with the average housing transaction in Ontario. The study reveals that, over a period of three years from the date of purchase, an average housing transaction in Ontario generates a total of $73,250 in ancillary expenditures. These expenditures encompass a wide range of costs, including, but not limited to, legal fees, moving expenses, furniture purchases, and renovation costs.

"This data underscores the significant financial impact that a housing transaction can have on both homebuyers and the wider economy. According to this report, the home sales recorded by LSTAR in February 2023 could potentially bring over 31 million in spin-off spending to our local economy by 2026,” Miller added.

“The demand for housing in our area continues to remain strong, fueled by the rapid growth of our local communities. We cannot predict if this demand will result in an increase in home renters or a higher homeownership rate. The only thing we know for sure is that interest rates and borrowing costs have a significant impact on housing affordability.

As such, prospective homebuyers and renters should keep a close eye on economic trends and the actions of policymakers in the coming months and years. By being aware of the factors that shape the housing market and by talking to a local REALTOR®, they’ll be able to make more informed decisions about their housing needs and options.” Miller concluded.

1Economic Impacts of MLS® Systems Home Sales and Purchases in Canada and the Provinces, Altus Group, 2019